Weekly Tech+Bio Highlights #45: Biotech Funding Reset & What Workers Actually Want from AI Agents

Also: Can LLMs Keep Up with Medical Experts? NHS Says AI Scribes Are Now Medical Devices; Testing Seizure Drugs on Neurons in a Dish & Building Human Pain Circuits from Multiple Organoids

Hi! This is BiopharmaTrend’s weekly newsletter, Where Tech Meets Bio, where we explore technologies, breakthroughs, and cutting-edge companies.

If this newsletter is in your inbox, it’s because you subscribed, or someone thought you might enjoy it. In either case, you can subscribe directly by clicking this button:

In this issue, Nabla secured $70M to scale AI clinical agents across 130+ health systems, while Insilico Medicine finalized its Series E at $123M. On the regulatory front, the FDA approved Gilead’s long-acting HIV prevention injection, and NHS England formally classified AI scribes as regulated medical devices. In its first preprint, Xaira Therapeutics released an 8-million-cell Perturb-seq atlas for AI-driven virtual cell modeling. Today, Illumina announced a $350M acquisition of SomaLogic to expand its NGS-based proteomics and multiomics.

The highlights above are a quick summary—hyperlinked stories with more detail are organized in the sections below.

For those tracking the convergence of AI and gene editing, don’t miss our latest deep dive. It covers how newer companies are using AI to design compact nucleases, refine guide RNAs, and develop tools across DNA, RNA, and epigenetic editing layers. The piece includes technical descriptions, company profiles, and a breakdown of current funding and development activity.

🤖 AI x Bio

(AI applications in drug discovery, biotech, and healthcare)

🔹 Xaira Therapeutics releases largest Perturb-seq atlas for virtual cell modeling—new dataset profiles 8M cells with genome-wide CRISPRi perturbations and continuous knockdown scaling, enabling AI models to simulate gene function and cellular responses more precisely.

🔹 Axiom Bio releases liver toxicity dataset for AI models—new resource includes profiles for 130,000 compounds with high-content imaging from human hepatocytes to enable improved AI prediction of drug-induced liver injury.

🔹 NVIDIA releases agentic AI for drug discovery—new blueprint automates literature review and hypothesis generation using multi-agent systems and virtual screening, accelerating early-stage R&D with explainable, modular workflows.

See also: The Rise of AI Agents in Biotech, Where Are We Now?

🔹 SandboxAQ releases synthetic 3D molecule data for AI drug discovery—Nvidia-backed startup generated 5.2M protein-binding structures using physics-based simulation to train AI models that predict drug-target interactions without lab experiments.

🔹 Isomorphic Labs expands to U.S. with key hire—AI drug discovery company appointed Dr. Ben Wolf as CMO and opened a Cambridge, MA hub to drive clinical translation of its AI-designed therapies.

🔹 AI meets immunotherapy biomarker discovery—Agenus and Noetik partnered to identify predictive biomarkers for a CTLA-4/PD-1 immunotherapy combo using virtual cell foundation models.

🔹 Biobank data goes AI-ready at global scale—Elucidata and Sapien Biosciences partnered to transform over 300,000 biospecimens from Asia’s largest biobank into harmonized, multimodal datasets for AI-driven drug discovery, rare cancer research, and diagnostic development.

🔹 17,000-sample aging study fuels AI drug discovery—BioAge Labs will analyze molecular profiles from over 17k HUNT Biobank samples using machine learning to identify targets for aging-related diseases.

🔹 Multi-agent AI links animal resilience to human disease—Fauna Bio launched a platform using autonomous systems and cross-species omics from 292 mammals to identify conserved targets for cardiometabolic and neuroprotective drug discovery.

🔹 Paige announces AI integration with Roche platform—diagnostic tools will be embedded into Roche's navify system to support digital pathology workflows.

🔹 BioAro launches unified multi-omics AI platform—new system merges diverse omics with real-time, multilingual reporting and generative drug discovery to accelerate precision medicine.

🔹 AstraZeneca and University of Cambridge present Edge Set Attention (ESA), a new graph learning architecture that outperforms traditional GNNs and graph transformers in molecular property prediction—scaling efficiently, improving transfer learning, and potentially accelerating in silico drug discovery.

🚜 Market Movers

(News from established pharma and tech giants)

🔹 FDA approves first twice-yearly HIV prevention injection—Gilead’s lenacapavir becomes the only PrEP option approved for six-month protection, showing ≥99.9% efficacy in Phase 3 trials.

🔹 Johnson & Johnson’s CD19/CD20-targeting CAR-T therapy reportedly showed a 100% response rate in early lymphoma patients and 92% in heavily pretreated cases.

🔹 NextCure licensed ex-China rights to Simcere’s early-stage cancer antibody-drug conjugate (ADC) in a deal worth up to $745M.

💰 Money Flows

(Funding rounds, IPOs, and M&A for startups and smaller companies)

🔹 Illumina to acquire proteomics firm SomaLogic for $350M plus up to $75M in milestones, integrating its aptamer-based platform to accelerate Illumina’s multiomics strategy and expand its NGS-driven proteomics offerings.

See also: Next Generation Sequencing: New Tech and Companies to Watch

🔹 Nabla raises $70M to expand agentic AI for clinicians in Series C to scale its AI platform that automates documentation and EHR tasks across 130+ healthcare systems, supporting 85,000+ clinicians in 35 languages.

🔹 Ryght AI raises $3M to automate trial site activation—startup uses agentic and gen-AI with digital twins of 100,000 global sites to streamline feasibility, selection, and enrollment to cut activation timelines to weeks.

🔹 Insilico Medicine finalizes $123M Series E—AI drug discovery firm closed an oversubscribed round to support clinical trials, lab automation, and expansion of its AI-plus-wet-lab pipeline.

🔹 UK-based Colorifix raises $18M in a Series B2 round led by IKEA’s innovation arm to scale its microbial dyeing technology, which replaces petrochemical dyes with DNA-inspired pigments grown by engineered microbes.

🔹 Tennr raises $101M Series C for AI referral automation—health tech startup secured funding to scale its vision-language platform that processes 10M documents monthly, automating pre-visit workflows and improving referral visibility across 130+ healthcare networks.

🔹 $494M IPO to expand AI precision oncology — Caris Life Sciences raised $494M at a $5.9B valuation to scale FDA-approved cancer diagnostics that use ML on genomic and transcriptomic data for therapy matching.

🔹 Lilly on one-time gene editing for heart disease—Eli Lilly will acquire Verve Therapeutics for up to $1.3B to advance single-dose gene editing therapies targeting key drivers of atherosclerotic cardiovascular disease.

🔹 UK neuropsychiatry startup launches with $140M—Draig Therapeutics, spun out of Cardiff University, raised $140M in Series A to advance an AMPA receptor-targeting depression drug into phase 2 and develop two GABA modulators for clinical trials in 2026.

⚙️ Other Tech

(Innovations across quantum computing, BCIs, gene editing, and more)

🔹 First real-time voice from brain signals—UC Davis developed a brain-computer interface that decodes speech-related brain activity into synthesized voice nearly instantly, enabling a man with ALS to converse, change intonation, and sing with 60% intelligibility.

🔹 China launches first invasive BCI trial—a research team in Shanghai implanted a miniaturized brain-computer interface in a quadriplegic patient, enabling mind-controlled gaming and making China the second country to reach clinical trials for invasive neural interfaces.

🔹 FutureHouse co-founder Andrew White shares how building robust reward functions for ether0 (a recent 24B-parameter, chemistry-specialized reasoning model) required preventing reward hacking, where models exploit flaws in scoring logic to maximize rewards without solving the intended chemistry tasks.

🏛️ Bioeconomy & Society

(News on centers, regulatory updates, and broader biotech ecosystem developments)

🔹 FDA launches fast-track voucher program—new initiative will grant select companies priority vouchers to cut drug review times to 1-2 months, targeting public health needs and innovation, with a pilot phase starting in 2025.

🔹 Genomics launched the UK-wide rollout of its AI-enabled test combining polygenic risk scores and clinical data to predict common diseases, marking the first UKCA- and MHRA-approved tool of its kind.

This newsletter reaches over 8.8K industry professionals from leading organizations across the globe. Interested in sponsoring?

Contact us at info@biopharmatrend.com

Biotech Reset in Progress

Melanie Senior’s feature published on June 16, 2025, in Nature Biotechnology describes the current state of biotech financing, highlighting a distinct split: well-funded biotechs in popular fields thrive, while early-stage, platform-focused firms struggle or vanish altogether amid macroeconomic stress and uncertain policy climates.

Senior provides a snapshot of funding trends, market dynamics, and the shifting strategies of venture capital (VC) firms adapting to these conditions.

Some takeaways:

Biotech investment in 2025 remains steady overall, projected near $27 billion, comparable to 2024, but the money flows into fewer and bigger rounds.

A deep divide emerges, with investors strongly favoring biotechs in “hot” therapeutic areas like neurology, immuno-inflammation, and advanced cancer therapies, neglecting early-stage or preclinical startups.

Seed funding is at a decade low, yet average seed round sizes doubled ($15 million) due to substantial investments in high-profile fields like AI-driven platforms and advanced antibodies.

Series A rounds ballooned, with multiple financings over $100 million, signaling investor preference for substantial, milestone-driven cash runways.

Public biotechs are facing valuation crises, with around 40% trading below their cash holdings and preclinical-stage companies suffering the most severe declines (90% drop over four years).

Biotech venture capital itself is consolidating, with the top 30 US funds raising 75% of total capital in 2024, making fundraising especially tough for newer VCs.

M&A activity briefly surged in early 2025 but slowed amid heightened political uncertainties, including US tariffs and drug pricing debates.

Pharma companies are increasingly selective, favoring approved or late-stage assets and structuring deals with substantial contingent payments linked to regulatory success.

The rise of Chinese biotech greatly impacts global deal flow, with over 30% of licensing deals involving Chinese assets—a tenfold increase from five years ago.

VC strategies increasingly align directly with pharma acquisition interests, driving herd behavior toward fewer innovation pathways, raising concerns about long-term diversity in biotech innovation.

Senior emphasizes that despite challenges, the current pressures could lead to a leaner, more resilient biotech sector. Investors and companies are increasingly focused on tightly run, pharma-aligned models with clearer paths to commercialization. China's competitive role reshapes global dynamics, forcing Western biotech firms to sharpen focus and accelerate their innovation cycles.

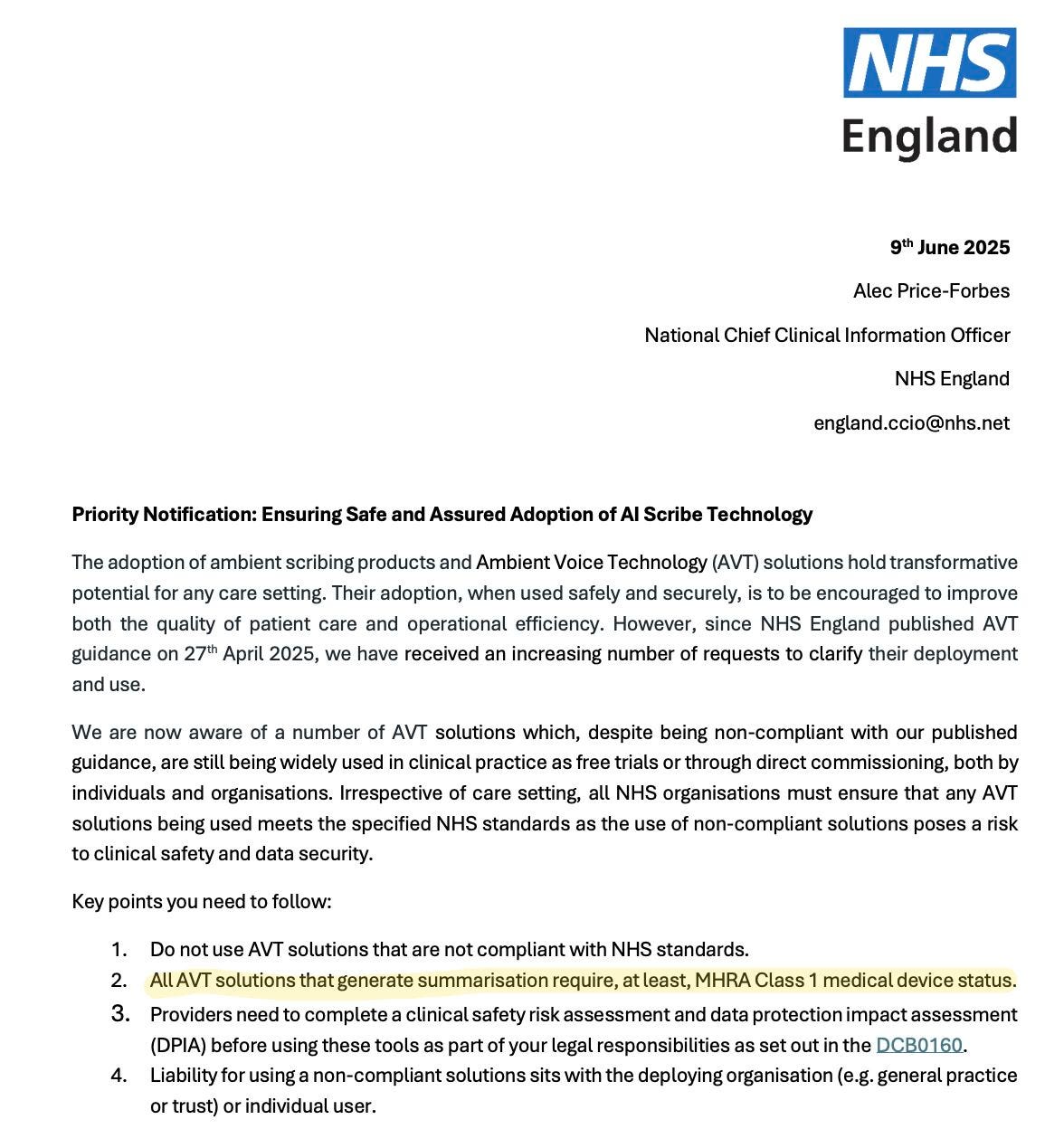

NHS: AI Scribes Are Now Medical Devices

On June 9, NHS England issued a system-wide directive reclassifying Ambient Voice Technology (AVT), commonly known as AI scribes, as regulated medical devices. Under the new guidance, any tool that performs clinical summarization must now carry, at minimum, MHRA Class 1 medical device status. Tools generating diagnoses or care plans will require Class 2a status.

The notification, signed by National Chief Clinical Information Officer Alec Price-Forbes, warns that liability for non-compliant deployments will rest with the implementing organization or individual user. Effective immediately, NHS bodies must pause or halt use of AVT solutions that don’t meet data protection, clinical safety, and technical integration standards (including DPIA, DCB0160, and DTAC compliance). Suppliers are expected to demonstrate real-world NHS validation and clear economic justification.

As Rik Renard noted in his commentary, the move marks the end of the “move fast” era for ChatGPT-based tools and wrapper startups in UK healthcare.

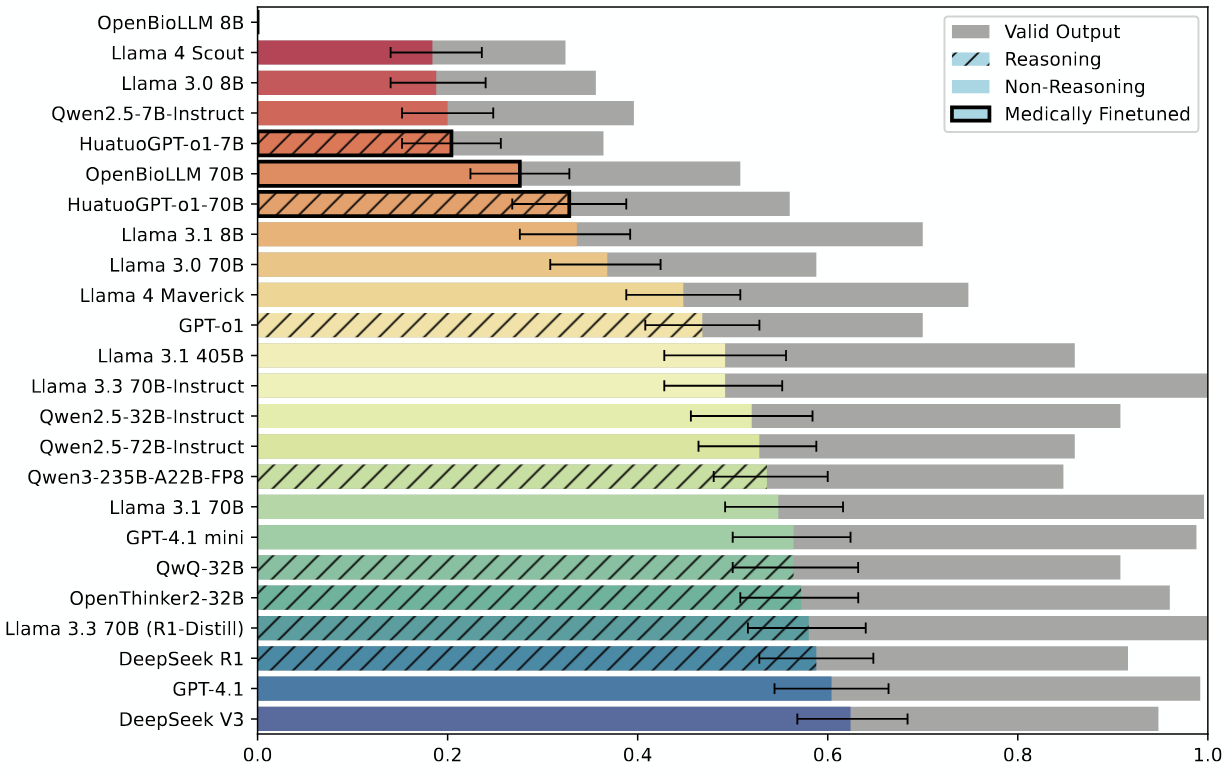

Can LLMs Keep Up with Medical Experts?

A recent study from Stanford and collaborators introduces MedEvidence, a new benchmark for testing whether large language models can replicate the conclusions of expert-written medical systematic reviews. The team paired 100 reviews with their source studies and posed structured questions based on the reviews’ main findings—then tested 24 LLMs, including models like GPT-4.1 and DeepSeek V3.

Performance varied. Larger models didn’t consistently outperform smaller ones. Medical fine-tuning tended to reduce accuracy. Reasoning models didn’t do better than non-reasoning ones. Across the board, LLMs showed a tendency toward overconfident answers and rarely flagged uncertainty, even when the original review did. Accuracy dropped as input length increased and improved only when the evidence was especially clear or when all source studies agreed.

According to the authors, the models failed to match expert conclusions in at least 37% of cases. The dataset and code have been released to help evaluate future models against expert benchmarks grounded in clinical literature.

What Workers Actually Want from AI Agents

Stanford’s WORKBank study audits where AI agents are most wanted, where they’re feasible—and where the two don’t match. The team surveyed 1,500 workers across 104 occupations, matched their preferences to expert assessments, and analyzed 844 tasks using a five-level Human Agency Scale (H1–H5), ranging from full automation to essential human involvement.

Nearly half of the tasks saw positive sentiment toward automation, mostly for repetitive or low-value work. But workers often preferred collaborative setups (H3), even where experts rated tasks as automatable (H1–H2). This gap suggests that current technical progress is outpacing comfort with full handoff.

The study also highlights an “R&D Opportunity Zone”—tasks where workers strongly want AI support, but current systems fall short. Many of them involve domain-specific workflows outside the current focus of AI startups or research papers.

This desire–capability landscape flags overlooked areas where AI is both wanted and feasible (green light zone), and highlights a cluster of investment in tasks with low demand for automation (red light/low priority zones). The Human Agency Scale helped clarify where human input still matters, and in many cases that ideal sits somewhere around shared control.

Building Human Pain Circuits from Multiple Organoids

Researchers at Stanford have developed a four-part human assembloid model (hASA) that mimics the ascending somatosensory pathway, integrating peripheral sensory neurons with spinal cord, thalamic, and cortical components. Assembloids are multicellular structures formed by combining region-specific organoids, allowing researchers to model complex circuits in vitro. In this case, all parts were derived from human pluripotent stem cells.

In this system, signals move through a pain-related pathway, observable via calcium and electrical activity. A noxious chemical triggered synchronized network-wide activation, mimicking the brain’s response to pain. When the SCN9A gene essential for pain perception was knocked out, the network lost coordination. A mutation linked to extreme pain produced hypersynchrony, echoing clinical phenotypes.

Unlike isolated organoids, hASA captures emergent properties like circuit-wide synchrony, offering a new platform to study human pain mechanisms, neurodevelopmental sensory disorders, and therapeutic screening. The team suggests future expansions could incorporate additional sensory pathways or more mature cell types to better model postnatal and adult systems.

Testing Seizure Drugs on Neurons in a Dish

In a Communications Biology study published June 17, Brett Kagan and colleagues at Cortical Labs (the company that recently launched a $35k biological computer built on human neurons and silicon hardware) used a simplified in vitro model of epilepsy, built from human iPSC-derived glutamatergic neurons, to test how anti-seizure medications affect information processing.

Using the DishBrain platform, which embeds neural cultures in a closed-loop Pong-like game environment, the team found that carbamazepine not only reduced hyperactivity but also restored rudimentary learning capacity. Other drugs suppressed firing but failed to improve gameplay.

This is reportedly the first demonstration that drug treatments can modulate the functional behavior of synthetic biological intelligence (SBI) systems, possibly opening a path toward assessing both neural excitability and information-processing deficits in disease models.

Correction notice: In our recent deep dive “12 Startups Applying AI to Gene Editing: From Custom CRISPR to Zinc-Finger Revivals”, we incorrectly stated that artificial intelligence was used in designing a base-editing therapy for CPS1 deficiency. The treatment was not AI-guided. Both the headline and body text have been updated to reflect this. We regret the error.

Read also:

13 Foundation Models: Startups, Industry Updates and the Nobel Prize