Weekly Tech+Bio Highlights #69: Big Pharma Keeps Tapping Multimodal AI Stacks

JPM takeaways; reality check on de novo antibody design; 2026 biotech & clinical AI reports, and more

Hi! This is BiopharmaTrend’s weekly newsletter, Where Tech Meets Bio, where we explore technologies, breakthroughs, and cutting-edge companies.

If this newsletter is in your inbox, it’s because you subscribed, or someone thought you might enjoy it. In either case, you can subscribe directly by clicking this button:

This newsletter reaches over 11K industry professionals from leading organizations across the globe. To reserve your sponsor slot in one of the upcoming issues, contact us at info@biopharmatrend.com

🤖 AI x Bio

(AI applications in drug discovery, biotech, and healthcare)

🔹 AI revives stalled drug program — Takeda is embedding AI across drug discovery after Boston AI partner Nabla helped rescue a failing preclinical antibody.

🔹 ByteDance challenges AlphaFold with new protein folding model — The TikTok maker’s SeedFold builds on AlphaFold 3 and sets new benchmarks on FoldBench, inheriting an AlphaFold3-style architecture while widening the Pairformer and introducing linear triangular attention.

🔹 Tahoe Therapeutics, Arc Institute, and Chan/Zuckerberg’s Biohub have partnered to create the largest open dataset for virtual cell modeling, combining 120M single-cell profiles and 225K drug-patient perturbations for AI models of cellular behavior and treatment response.

🔹 Recursive Language Models reframe AI reasoning limits — Bo Wang (Xaira Therapeutics, UHN) highlights how Recursive Language Models (RLMs) challenge the belief that long-context AI reasoning is just a memory problem, instead enabling scalable, structured thinking by programmatically decomposing tasks rather than ingesting more data (an approach his team is testing in clinical trial applications).

🔹 Industrializing tissue replacement — Cambridge-based Cellino and Polyphron partner to combine AI-driven iPSC manufacturing with autonomous tissue engineering to scale personalized regenerative therapies through end-to-end, reproducible production systems.

🔹 Natera partners with NVIDIA to train large-scale foundation models on longitudinal oncology datasets for improved diagnostics, immunotherapy prediction, and biomarker discovery with high-performance AI infrastructure.

🔹 Leadership moves in AI-Driven biotech — Novo Nordisk appointed Anja Leth Zimmer as its first Chief AI Officer; BioMarin named Arpit Davé as Chief Digital and Information Officer, and Rune Labs tapped former Tempus executive Amy Gordon Franzen as CEO to lead expansion of its AI neurology platform.

🔹 CytoReason launches LINA, an NVIDIA-powered AI agent built on computational disease models to generate reproducible analyses and insights.

🚜 Market Movers

(News from established pharma and tech giants)

🔹 Google expands medical AI suite with imaging and speech models — releasing MedGemma 1.5 for high-dimensional medical imaging and MedASR for speech recognition, alongside a $100K Kaggle hackathon centered on open-source clinical AI development.

🔹 Pfizer taps SF-based Gordian Bio’s in vivo and ML platform for obesity targets — to screen gene targets in visceral fat using its in vivo mosaic platform and Pythia machine learning engine to identify therapeutic interventions for obesity with tissue-specific precision.

🔹 BMS taps Immunai’s AI to decode immune responses — Bristol Myers Squibb partners with US-based Immunai to analyze clinical trial data using its AI-powered immune atlas; Immunai now provides free single-cell multi-omic profiling to Mount Sinai, Weill Cornell, and Massachusetts General Hospital.

🔹 Illumina launches Billion Cell Atlas for AI drug discovery — launching the first phase of a 5-billion-cell CRISPR perturbation dataset, partnering with AstraZeneca, Merck, and Eli Lilly to train AI models and validate genetic drug targets across hard-to-treat diseases.

🔹 Insilico Medicine brings AI drug discovery model to Microsoft platform — integrating its Nach01 foundation model with Microsoft Discovery to enable scalable, AI-native workflows for molecular design and predictive analysis in drug discovery.

🔹 JPM 2026: CEOs of Novo Nordisk, BMS, and Pfizer lay out their bets — Novo Nordisk’s Mike Doustdar called 2026 a “year of price pressure,” citing the Trump administration’s GLP-1 pricing deal and growing competition. Bristol Myers Squibb’s Chris Boerner previewed 10 potential product launches by 2030, with 11 key readouts expected this year. Pfizer’s Albert Bourla reaffirmed the company is “all in on obesity,” with 10 late-stage trials planned for Metsera assets and strong expectations from the growing cash-pay market.

💰 Money Flows

(Funding rounds, IPOs, and M&A for startups and smaller companies)

🔹 Nearly $1B in new biotech VC funds launch globally — Andreessen Horowitz commits $700M to U.S. biotech innovation with a focus on AI applications, while Germany’s BioNTech and Penn back a $50M fund for Pennsylvania startups, and France’s Servier launches a €200M fund targeting European oncology and neurology firms.

🔹 Denmark’s Novo Nordisk Foundation will invest ~$856M over nine years into BioInnovation Institute to expand life sciences and AI-driven startups across Europe, scaling its support beyond Denmark and into quantum and reproductive health.

🔹 AstraZeneca acquires Boston’s Modella AI to embed foundation models and AI agents across its global cancer pipeline for biomarker discovery, pathology analysis, and trial design through multimodal data integration.

🔹 OpenAI acquires health records startup Torch for reported $100M — Torch built a “medical memory” that unifies fragmented health data for AI use. Its four-person team joins OpenAI to support ChatGPT Health, a new initiative aimed at helping users analyze and manage personal health through the chatbot.

🔹 Nuclera extends Series C to $87M for antibody engineering platform — UK- and US-based company raises an additional $12M to expand its eProtein Discovery system with full-format antibody expression and validation, aiming to generate high-quality datasets for AI-driven biologics discovery.

🔹 $80M for AI-driven protein interaction drugs — New York-based Proxima raises $80M to develop proximity-based medicines using generative AI and structural proteomics to design small molecules that modulate protein-protein interactions; backed by DCVC, Nvidia, and Roivant.

🔹 Boston/Tel Aviv-based Converge Bio raises $25M to expand generative AI systems trained on DNA, RNA, and protein sequences, enabling pharma clients to design antibodies and optimize protein yield with integrated predictive and physics-based validation.

🔹 Juvena Therapeutics secures $33.5M Series B to progress its tissue-restorative biologics pipeline and AI discovery platform, backed by Bison Ventures, Eli Lilly, and others, amid ongoing Phase 1 trials for muscle regeneration.

🔹 $50M to scale human cell programming — UK-based bit.bio secures $50M Series C to expand its ioCells platform for drug discovery and toxicology, generating AI-ready human cell data to reduce animal testing and improve preclinical model accuracy.

🔹 Lux Capital raises $1.5B for frontier tech and AI — NY-based Lux Capital closes its largest fund to date amid a weak VC market, doubling down on AI, defense, and deep tech after early wins with Anduril, Hugging Face, and Recursion, and Auris Health, which sold to J&J for up to $6B.

🔹 UK-based Allos secures $5M to apply Causal AI to the redesign of hard-to-genericize small-molecule drugs.

🔹 Avenue Biosciences secures $5.7M to scale its AI-enabled platform that modulates the secretory pathway using engineered signal peptides, improving yield and manufacturability of complex therapeutic proteins.

⚙️ Other Tech

(Innovations across quantum computing, BCIs, gene editing, and more)

🔹 MIT spotlights biotech’s leap into personalized and regenerative medicine — In its Ten Breakthrough Technologies (2026), MIT Technology Review highlights advances like personalized base editing in infants, embryo genetic scoring, and gene “resurrection,” signaling a shift toward bespoke gene therapies, AI-integrated biology, and deeper manipulation of human development and disease.

🔹 Vascularized retinal organoids achieve full light-signal transmission. Researchers at University Hospital Bonn and partners integrated endothelial cells into retinal organoids, enabling nutrient flow, boosting ganglion cell survival, and—for the first time—establishing functional light pathways from photoreceptors to optic nerve cells in vitro.

🔹 CurifyLabs debuts 3D printer for scalable drug compounding that enables faster, modular preparation of personalized medicines in pharmacies

🏛️ Bioeconomy & Society

(News on centers, regulatory updates, and broader biotech ecosystem developments)

🔹 China’s biotech VC diverges on exits, incentives, and scale — a new BridgeCross Bio piece dissects how China’s life science venture ecosystem differs from the West, drawing on perspectives from firms like Sofinnova Partners, Sunstone Life Science Ventures, Apricot Capital, and a top Chinese VC; key themes include RMB fund dominance, founder resistance to M&A, and why Western VCs remain cautious despite China’s speed and scale.

🔹 Big Pharma eyes M&A surge as patents expire. With nearly $180B in drug revenues set to go off patent by 2028, major pharma companies are ramping up dealmaking, fueled by regulatory clarity, surging biotech stocks, and pressure to replenish pipelines, setting the stage for a wave of large-scale acquisitions in 2026.

🔹 JPM shifts from megadeals to meetings — Despite no major announcements, the 2026 J.P. Morgan Healthcare Conference remained packed with biopharma networking, as companies increasingly drop news before the event or pivot toward smaller conferences, possibly reflecting a broader evolution in how and where the industry communicates.

🚀 A New Kid on the Block

(Emerging startups with a focus on technology)

🔹 Merge Labs emerges with $252M to develop non-invasive brain-computer interfaces — Backed by OpenAI, Bain Capital, and Gabe Newell, the startup is building ultrasound-based neurotechnology as an alternative to implanted BCIs. A spinoff from Forest Neurotech, Merge aims to interpret and modulate brain activity via blood flow dynamics, with AI foundation models aiding in signal interpretation.

🔹 Tahoe Therapeutics and Alloy Therapeutics form a new company to develop antibody-drug conjugates targeting novel tumor antigens discovered via Tahoe’s AI-powered single-cell platform, combining target discovery with Alloy’s ADC engineering and venture creation infrastructure (namely, 82VS).

Reality Check on AI Antibody Design

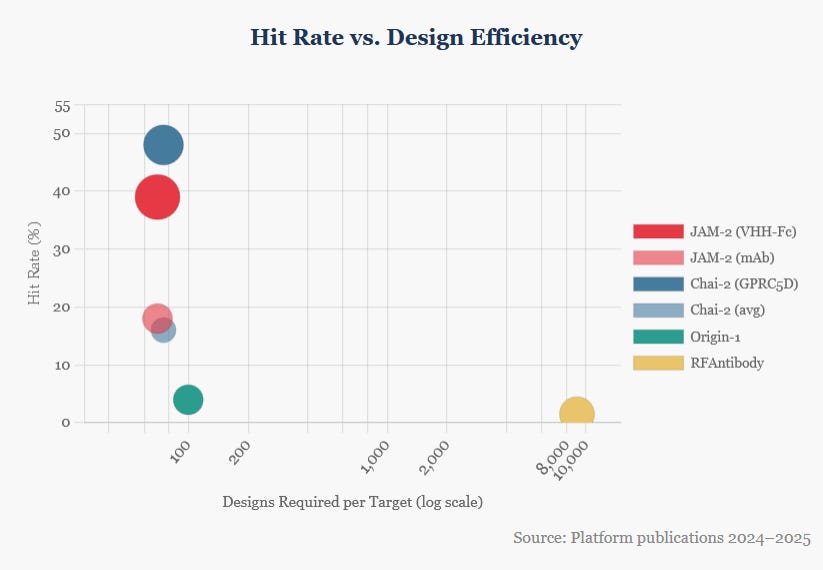

We recently read a head-to-head analysis comparing several of the current de novo antibody design models: Nabla Bio’s JAM-2, Chai Discovery’s Chai-2, Absci’s Origin-1 (built on Boltz), and the Baker Lab’s RFAntibody.

Traditional antibody discovery still largely means immunizing mice, waiting for an immune response, generating hybridomas, and screening thousands of candidates. That process typically takes 12–24 months, and many programs never produce a viable lead.

In short, JAM-2 and Chai-2 come out ahead overall, with relatively small differences between them. JAM-2 looks stronger on reported hit rates and affinities across many targets, while Chai-2 stands out on structural validation and target breadth. But the more interesting point is how much better all of these systems look compared with what was considered state of the art roughly a year ago, both in speed and in the likelihood of getting binders at all.

There is particular emphasis on GPCRs, which account for about 34% of approved drugs but are almost exclusively targeted by small molecules rather than antibodies. JAM-2 reports low-nanomolar binding to CXCR4, but Chai-2 reports a CXCR4 antibody with measurable agonist activity based on downstream signaling assays—“to design an antibody that not only finds its target but also induces a specific functional response represents capability that simply didn’t exist before.”

Highlights

Hit rates at 39%

Weeks-long timelines vs 12-24 months traditionally

AI-designed antibody with GPCR-activating activity (a first)

KRAS mutant discrimination at the single-amino acid level

That said, the analysis is explicit about the limits of what’s been shown so far:

No in vivo data. None of the platforms report mouse PK, xenograft studies, or other in vivo proof of concept.

Immunogenicity remains untested. The designed CDRs are novel, and anti-drug antibody risk is unknown. Clinical data is still years away.

Manufacturing is unvalidated. There is no public evidence yet of large-scale CHO production for these designs.

Access is limited. JAM-2, Chai-2, and Origin-1 are proprietary, while RFAntibody is open but requires thousands of designs per target.

Hit rate does not equal a drug. Affinity maturation, epitope tuning, and format engineering remain largely downstream work.

The expectation is that the next meaningful milestones are in vivo data and IND-enabling work, rather than further gains in raw hit rates. At least one group signals that those steps may be approaching, but for now that’s still prospective.

How AI Brings Drug Testing Closer to Human Biology

In her latest column on rare diseases at BiopharmaTrend, our regular contributor Louise von Stechow, PhD, examines how drug testing is gradually shifting away from animal models toward more human-relevant, technology-driven approaches, with AI playing an increasingly visible role. Drawing on examples from toxicology, ADME, and disease modeling, she outlines why animal studies often fall short in predicting human outcomes, particularly in rare and multisystem disorders where suitable models are limited or absent.

Advanced human cell systems, organoids, and organ- and patient-on-chip platforms can capture patient-specific biology, but remain labor-intensive and reductionist. AI models are increasingly layered on top of these systems and historical clinical data to scale predictions, flag toxicity risks such as liver or cardiac injury, and support ADME and dose modeling in ways that are difficult to achieve with animal studies alone.

Von Stechow situates these technical developments in a changing regulatory and industrial context, where agencies in the US and EU are beginning to accept non-animal methods in defined settings, and both public initiatives and biotech companies are investing in computational and hybrid alternatives to traditional preclinical testing. The overall picture is one of incremental change, with AI and human-based models used to focus animal studies where they are most informative.

The full column, with detailed case studies and examples, is available on our website here.

2026 Biotech & Clinical AI Reports

Two reads that came across our desk recently: one is Benchling’s 2026 Biotech AI Report, which is based on data from 100 biotech and biopharma organizations already using AI in R&D and is trying to separate “daily driver” use cases from the stuff that still stalls out on data and workflow friction. The other is ARISE’s State of Clinical AI Report 2026, positioned as an annual synthesis of what is holding up in real clinical settings and what is not, with an emphasis on evaluation quality.

Benchling: 2026 Biotech AI Report

Benchling posits this as a November 2025 survey of about 100 biotech and pharma orgs actively using AI in R&D, and explicitly says it is not meant to represent “general industry sentiment,” but a view into AI front-runners in the U.S. and Europe.

The earliest “wins” are workflow-native use cases with data that is comparatively clean and easy to sanity-check. They call out literature review (76% adoption), protein structure prediction (71%), scientific reporting (66%), and target identification (58%).

Adoption drops in more complex, regulated, or harder-to-validate domains like generative design, biomarker analysis, and ADME. The report points to data being scattered, incomplete, and hard to validate as a core limiter.

Their “planned growth” list leans toward more integrated systems, including workflow orchestration, manufacturing optimization, multimodal models, and “co-scientists.”

They claim AI is becoming a default interface for scientists, reporting 89% using copilots or reasoning tools as a first stop for interrogating and synthesizing data.

On org design, they report internal upskilling as the top talent source (67%), versus hiring from tech (21%).

On impact, they report that 50% “report faster time-to-target today” and 56% “expect cost reductions within two years,” explicitly tying the latter to scaling automation and agentic workflows.

On what breaks pilots, they state the number one reason AI pilots fail is challenges with data quality.

ARISE: State of Clinical AI Report 2026

ARISE describes itself as an interdisciplinary research network, founded in 2024 as a collaboration between clinicians and researchers across multiple academic medical centers, focused on evaluating clinical AI through real-world studies, open benchmarks, and reproducible methods. In their positioning, the State of Clinical AI Report 2026 is framed as an inaugural annual synthesis that pulls together the current deployment landscape, the state of evaluation quality, and what kinds of evidence they think should come next.

Context

According to ARISE, AI is already embedded across healthcare, with 1,200+ FDA-cleared tools and 350,000+ consumer apps contributing to a $70B market, while only a minority of these systems have undergone peer-reviewed evaluation.

Among 691 FDA-cleared AI/ML medical devices cleared between 1995 and 2023, more than 95% went through the 510(k) pathway, which relies on equivalence to existing devices, including devices the report characterizes as sometimes being cleared on suboptimal evidence.

ARISE adds that FDA device summaries frequently lack key study details, reporting that about 50% omitted study design, 53% did not include sample size, and fewer than 1% reported patient outcomes. They also report that 95% of summaries did not include demographic data and 91% did not include bias assessments, and they frame these gaps as relevant to safety and equity in real-world use.

The report’s six key themes are:

Models made major leaps in actionable prediction and autonomous clinical reasoning, but the “jagged frontier” persists, including brittleness around uncertainty.

Real-world task evaluation is positioned as a prerequisite for trustworthy clinical AI, with a push beyond traditional QA-style benchmarks.

A shift from better models to better systems, including methods like multi-agent orchestration, multimodal models, and reasoning fine-tuning, with trade-offs.

Workflow design matters as much as model capability, with explicit attention to failure modes, automation bias, and deskilling risk.

Patient-facing AI is treated as its own category, where outcome measurement and safeguards are central and patients are not assumed to provide oversight.

The report argues the time for context-specific prospective trials is now, noting that randomized prospective trials have already started and framing 2026 as the next wave of evidence.