Weekly Tech+Bio Highlights # 61: Up to $2B for AI-Guided Blood-Brain Barrier Shuttles

Recursion’s Whole-Genome Microglia Map for Roche & Genentech; Roche x Manifold Bio BBB deal; Data Strategy & Model Architecture in Virtual Cells

Hi! This is BiopharmaTrend’s weekly newsletter, Where Tech Meets Bio, where we explore technologies, breakthroughs, and cutting-edge companies.

If this newsletter is in your inbox, it’s because you subscribed, or someone thought you might enjoy it. In either case, you can subscribe directly by clicking this button:

🤖 AI x Bio

(AI applications in drug discovery, biotech, and healthcare)

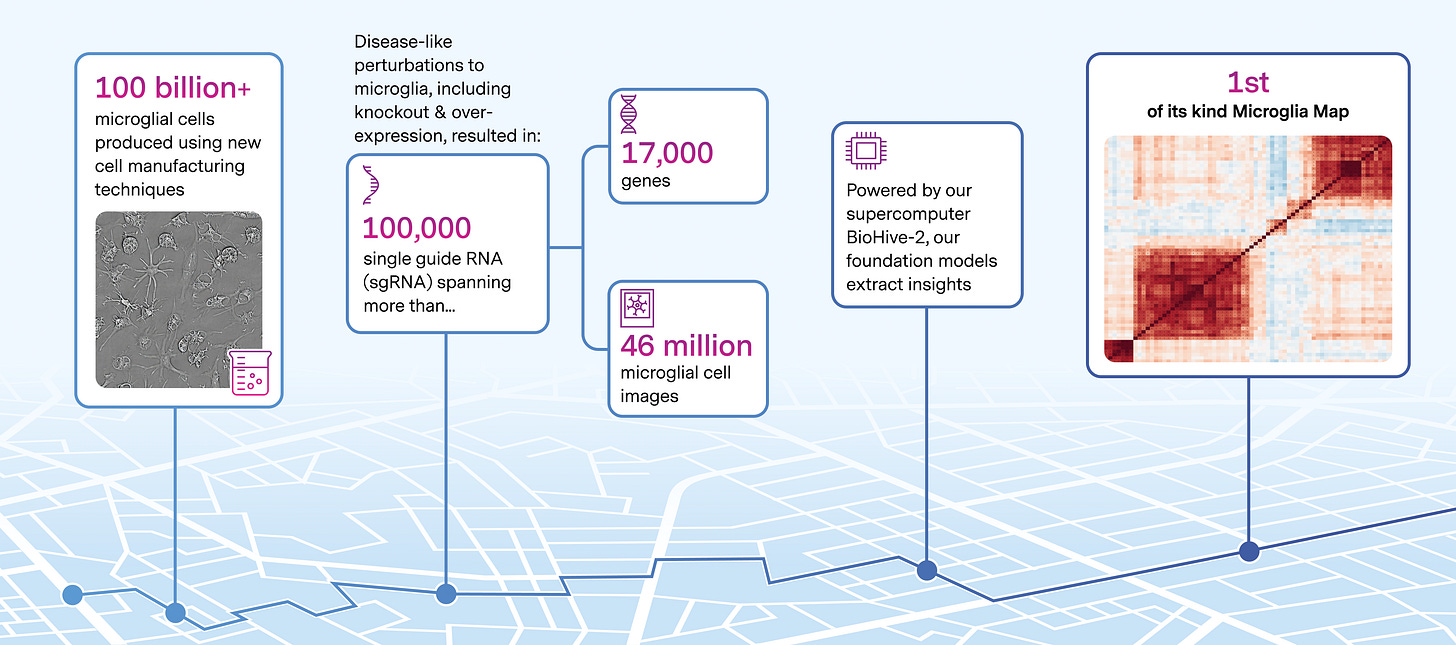

🔬 High-dimensional cell mapping for brain disease — Recursion completed its whole-genome Microglia Map with Roche and Genentech, capturing 46M images from 100B cells and 100K CRISPR knockouts to uncover new neurodegeneration targets, triggering a $30M milestone payment.

🔬 AI-guided therapy shows promise after CAR-T failure — Lantern Pharma reports a complete response in a relapsed DLBCL patient treated with LP-284, an AI-developed drug targeting DNA repair deficiencies, highlighting its potential in post-CAR-T and post-bispecific settings with ongoing Phase 1 trials.

🔬 Targeting drug-resistant eye infections — Locus Biosciences partners with Viatris to develop engineered bacteriophage therapies for ophthalmic bacterial infections, aiming to address rising antibiotic resistance using AI-driven phage design.

🔬 AI stack boost for health data — Verily is integrating NVIDIA’s tools into its precision health platform to accelerate genomics and multimodal model training by up to 10x, with initial deployments supporting NIH’s All of Us research program.

🔬 Guardant Health and Zephyr AI partner to combine genomic and clinical data with AI tools to identify biomarkers and predict cancer drug responses.

🔬 Foundation Medicine teams up with Manifold to upgrade its analytics platform and enable faster, AI-powered exploration of genomic data from 800,000+ cancer patients to support drug development.

🔬 Omnimodal AI foundation model — BostonGene to present studies at SITC 2025 (11.05-09) showcasing its omnimodal AI foundation model, which predicts treatment response, toxicity, and resistance mechanisms across cancer types using integrated molecular and clinical data.

🔬 AI meets dual-payload ADCs — Debiopharm partners with South Korea’s NetTargets to develop antibody-drug conjugates that carry two synergistic payloads, using AI to identify combinations that overcome resistance in tough-to-treat cancers.

🔬 Latus Bio is expanding its AI/ML strategy to improve AAV gene therapy design, using data from over 100 million in vivo capsid-tissue combinations. The company aims to apply machine learning to more precisely engineer capsids and payloads for targeted delivery. It also added two experts in protein and peptide modeling—Drs. Pranam Chatterjee and Philip Kim—to its scientific advisory board.

🔬 Pushing open science in virtual cell simulation — Chan Zuckerberg Initiative and NVIDIA expand their partnership to scale AI-driven virtual cell models, releasing open RNA and imaging models, standardized benchmarks, and petabyte-scale GPU tools to support collaborative, reproducible biology research.

🔬 Blood cancer research at scale — Flatiron Health launched six real-world datasets covering over 505,000 U.S. patients with blood cancers, including structured clinical, genomic, and longitudinal data to support AI model development and validation across research and drug discovery.

This newsletter reaches over 10K industry professionals from leading organizations across the globe. To reserve your sponsor slot in one of the upcoming issues, contact us at info@biopharmatrend.com

🚜 Market Movers

(News from established pharma and tech giants)

💰 Pfizer sues to block rival bid for obesity biotech — Pfizer files lawsuits against Metsera and Novo Nordisk after Novo made a $9B counteroffer to outbid Pfizer’s $7.3B deal.

🔬 Thermo Fisher expands AI-powered drug development — At CPHI Frankfurt, Thermo Fisher unveiled new capabilities under its Accelerator platform, and launched an AI partnership with OpenAI to speed clinical trials.

💰 Money Flows

(Funding rounds, IPOs, and M&A for startups and smaller companies)

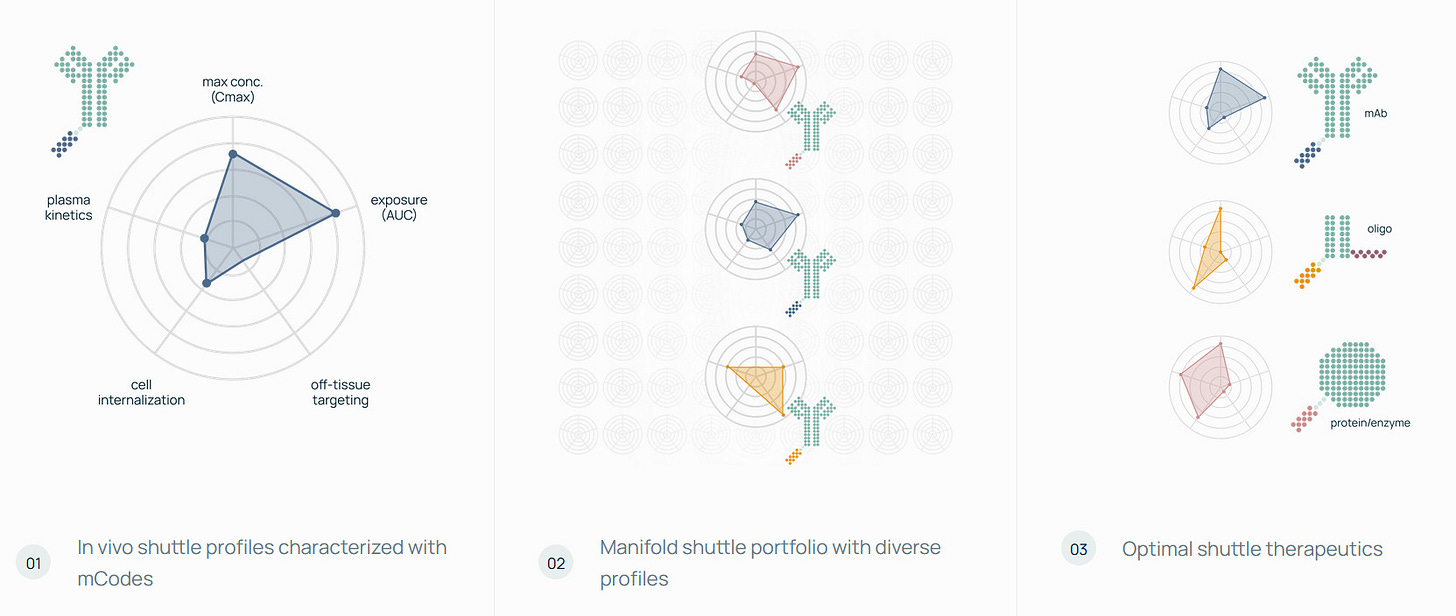

💰 Roche and Manifold Bio ink a deal worth up to $2B to co-develop AI-designed blood-brain barrier shuttles, aiming to improve CNS drug delivery by pairing Manifold’s in vivo screening and protein design platform with Roche’s clinical development expertise.

💰 Thermo Fisher will acquire Clario for $8.9B, a provider of clinical trial endpoint data solutions, to enhance its digital and AI capabilities in clinical research, expanding services for pharma and biotech customers and deepening its presence in trial data analytics.

💰 Curve Biosciences raises $40M to develop AI-driven blood tests for chronic disease monitoring, using a tissue atlas to train diagnostic models aimed at earlier and more accurate detection.

💰 Tubulis raises $401M to advance ADC pipeline — Germany-based Tubulis closes its Series C round at €344M, adding major institutional investors to accelerate clinical development of its antibody-drug conjugates, including pivotal trials for ovarian cancer and expansion into new tumor types.

💰 Helex raises $3.5M to target genetic kidney diseases — Helex secures seed funding to develop non-viral, kidney-targeted gene therapies, starting with a single-dose treatment for polycystic kidney disease using programmable lipid nanoparticles and AI-guided design.

🏛️ Bioeconomy & Society

(News on centers, regulatory updates, and broader biotech ecosystem developments)

🔬 At its second Cancer AI Symposium, Google Cloud showcased how pharma firms (like Eli Lilly), AI firms (e.g. Tempus, Recursion), and nonprofits are using generative and agent-based AI to accelerate compound discovery, real-time clinical guidance, and early diagnostics, with tools like MedGemma and ASCO’s Guidelines Assistant featured as key examples.

🚀 A New Kid on the Block

(Emerging startups with a focus on technology)

🚀 AI meets cell manufacturing — iOrganBio launches from stealth with $2M to develop CellForge, an AI-driven platform for scalable, reproducible cell and organoid production, aiming to accelerate drug discovery and regenerative medicine through precision-engineered human models.

Recursion’s Whole-Genome Microglia Map for Roche

Recursion’s Microglia Map—built from 46 million images and over 100 billion microglial cells—has been accepted by Roche and Genentech, triggering a $30M milestone payment. This brings total payments from the partnership to $213M, and over $500M across all of Recursion’s collaborations.

This one is Recursion’s second neuroscience map delivered under the Roche–Genentech deal and the sixth phenomap overall. It’s designed to give an unbiased, whole-genome view of microglial biology for applications in Alzheimer’s, Parkinson’s, MS, ALS, and other neurodegenerative programs.

Map highlights:

~100,000 sgRNA CRISPR-Cas9 knockouts across 17,000+ genes

Thousands of small molecules profiled

46 million images of hiPSC-derived microglia

Over 100 billion microglial cells generated

More than 1 trillion hiPSC-derived cells produced to date for neuroscience work

The work combines Recursion’s automated labs, large-scale perturbation systems, and ML-powered phenomics stack (Recursion OS) to map microglia function at a systems level—intended to surface new, difficult-to-find CNS targets.

AI-Guided In Vivo Screening for Brain Barrier Shuttles

Roche and Manifold Bio agreed to co-develop BBB shuttles for neurological and neurodegenerative programs, with $55 million upfront to Manifold and total milestones that could exceed $2 billion, plus tiered royalties.

Manifold runs discovery

Roche takes preclinical, clinical, and commercialization

Manifold keeps rights to use its BBB shuttles on non-licensed targets and can co-fund one candidate for higher royalty participation.

Manifold brings a specific angle with its mDesign platform: AI-guided protein design paired with direct in-vivo readouts using mCodes—peptide barcodes that let teams quantify hundreds of candidates across tissues in a single animal via affinity capture and DNA sequencing.

The system reportedly reaches single-digit picomolar sensitivity, supports 1,000+ barcodes, and enables millions of protein–barcode combinations. Manifold’s system is built to screen BBB shuttles that use different endothelial receptors and to design binders using structure-based models trained on high-throughput binding data.

The platform is also aimed at building an in-vivo “world model”—a predictive system linking protein design choices to whole-body distribution and behavior.

Virtual Cells: Data Strategy & Model Architecture

As more organizations aim to simulate cellular behavior in silico, a split is emerging in how to get there. Virtual cells are positioned to improve target identification, patient stratification, trial design, and biomarker development by testing hypotheses in silico before the wet lab. But success may hinge less on AI model design than on how training data is generated.

A recent In Vivo piece by David Wild highlights four efforts—Xaira, CZI, Recursion, and Noetik—each advancing a distinct data pipeline. Common thread: data strategy is defining the architecture, not the other way around. The piece places near-term commercial use for trial design/biomarkers in roughly 1–3 years, with patient-level simulation further out.

Xaira (perturbational data at scale). Focused on cause-effect learning via Perturb-seq, Xaira redesigned the workflow (“FiCS perturb-seq”) to reduce stress artifacts in genome-scale runs. It released a large public dataset and is generating proprietary data in iPSC-derived and planned in vivo systems. The aim: build models that prioritize high-confidence hypotheses for experimental validation—spanning target ID, toxicity, and MoA.

Chan Zuckerberg Initiative (modular foundations, open platform). CZI is assembling general-purpose models (e.g., TranscriptFormer, GREmLN, rBio) as building blocks for a composable virtual cell. Its platform will host and compare models across the community. Training spans natural variation and perturbations, with validation efforts expected in the next 2–3 years. The focus is on infrastructure, not therapeutics.

Recursion / Valence Labs (lab-in-the-loop from day one). Recursion integrates automated labs with phenotypic and structural modeling, using a “predict–explain–discover” loop. Lab experiments validate model uncertainty directly (active learning), with emphasis on mechanistic insight. Public datasets include RxRx3 and Phenom models; others remain proprietary for internal drug discovery.

Noetik (patient tissue first). Instead of cell lines or organoids, Noetik starts with real-world tumor samples (~3,000 patients, ~1 TB each) and uses self-supervised learning to uncover features relevant to response prediction. It’s already working with Agenus on biomarker discovery. A mouse-based PerturbMap system is used to cross-check predictions from human-trained models.

To see how each group frames the tradeoffs and what their approaches reveal about the future of predictive biology—read the full In Vivo piece here.

The push by these four fits into a much larger effort to model biology from first principles through AI. As Mitch Leslie recently noted in Science, the field is shifting from handcrafted systems of equations toward data-hungry foundation models trained on millions of single-cell profiles. Efforts such as the Arc Institute’s new Virtual Cell Challenge aim to benchmark these systems, testing whether they can truly infer causal biology or merely mirror correlations.

Early results suggest that despite the hype, performance still lags behind expectations, although each failure reveals where understanding is thin and data incomplete. The consensus, echoed by researchers from CZI’s Theofanis Karaletsos to Xaira’s Bo Wang, is that the models are still in their infancy, but that rapid gains in multimodal data, benchmarking, and compute will likely make today’s virtual cells look primitive.