Weekly Tech+Bio Highlights #58: Sanofi Licenses Neurosymbolic AI for Preclinical R&D

~$2.5B in Weekly Deal Value, Precision Oncology Flywheel, & Convergence of AI x CRISPR

Hi! This is BiopharmaTrend’s weekly newsletter, Where Tech Meets Bio, where we explore technologies, breakthroughs, and cutting-edge companies.

If this newsletter is in your inbox, it’s because you subscribed, or someone thought you might enjoy it. In either case, you can subscribe directly by clicking this button:

🤖 AI x Bio

(AI applications in drug discovery, biotech, and healthcare)

🔹 Benchmarking AI for cell modeling—Backed by over $1B in funding, Xaira Therapeutics published a Nature Biotechnology paper introducing the Systema framework to evaluate AI models of cellular perturbations, showing that broad systemic effects often overshadow gene-specific changes and that its fine-tuned scGPT outperformed existing approaches.

🔹 Big pharma doubles down on AI reasoning—a week after unveiling an R&D partnership with Thermo Fisher Scientific, Canada’s BenchSci signed a three-year deal to license its neurosymbolic AI platform to Sanofi, embedding structured, knowledge-graph–driven discovery tools across the pharma giant’s global preclinical research teams. (See our case study: How BenchSci’s ASCEND Builds a Map for Biomedical Reasoning)

🔹 Seattle-based startup Potato, which raised $4.5M earlier this year to build AI tools for lab automation, has partnered with Wiley to integrate 25,000+ validated methods from Current Protocols.

🔹 Mapping the brain—UCSF and the Allen Institute created a transformer-based model that mapped 1,300 mouse brain regions from spatial transcriptomics data, producing one of the most detailed, data-driven brain atlases to date and revealing new, biologically validated subregions.

🔹 AI drug rescue for failed clinical assets—Cambridge-based Ignota Labs acquired Kronos Bio’s discontinued CDK9 and SYK inhibitor programs, aiming to use its SAFEPATH AI platform to identify and fix toxicity issues that halted development.

🔹 Alpenglow Biosciences and Virdx have partnered to develop AI-powered prostate cancer diagnostics, combining Alpenglow’s 3D pathology imaging with Virdx’s MRI-based detection, powered by Nvidia’s GPU tech to create large-scale 3D datasets and accelerate clinical validation.

🔹 Spain’s MEDSIR is partnering with Ataraxis AI to integrate predictive algorithms into its breast cancer studies. The collaboration grants Ataraxis access to outcomes from over 1,000 patients. Read our in-depth interview with MEDSIR’s Business Development Director Rui Rui Zhang Xiang.

🔹 Pfizer’s Julian Cremer introduced FLOWR.root, a foundation model for 3D ligand generation and affinity prediction, emphasizing that benchmark results often reflect memorization rather than true generalization. He argues models must evolve with new experimental data, positioning FLOWR.root as a continuously fine-tunable companion tool for real-world drug discovery. (data, code)

🔹 Scaling single-cell and multi-omics research—Tempus AI joined Parse Biosciences’ service provider network to offer single-cell sequencing as part of its multi-omics platform. The partnership builds on Parse’s scalable Evercode technology and its Gigalab facility—recently key to generating the Tahoe100M single-cell dataset.

🔹 Natural language to lab automation—Biomni, an open-source biomedical AI agent, partnered with Retro Bio to integrate PyLabRobot, enabling generation of Hamilton STAR liquid-handling protocols from plain English; follows recent integrations with Consensus for literature analysis and Sage Bionetworks for natural language access to 3 PB of biomedical data.

This newsletter reaches over 9.9K industry professionals from leading organizations across the globe. To reserve your sponsor slot in one of the upcoming issues, contact us at info@biopharmatrend.com

🚜 Market Movers

(News from established pharma and tech giants)

🔹 Novo exits cell therapy research—Novo Nordisk is shutting down its 250-person cell therapy division, including a Type 1 diabetes program, as part of CEO Maziar Mike Doustdar’s $1.3B cost-cutting plan that will cut 9,000 jobs and refocus R&D on obesity and metabolic disease.

🔹 Parkinson’s cell therapy—BlueRock Therapeutics, acquired by Bayer in 2019 for up to $1B, reported 36-month Phase I data showing durable safety and motor improvement from its stem-cell-derived dopaminergic therapy bemdaneprocel. The update comes just three weeks after dosing the first patient in its pivotal Phase III trial—the world’s first late-stage study of an allogeneic pluripotent stem-cell therapy for Parkinson’s disease.

💰 Money Flows

(Funding rounds, IPOs, and M&A for startups and smaller companies)

🔹 Biotech pivots to AI drug discovery—Shuttle Pharmaceuticals plans a $10M cash-and-stock acquisition of Molecule.ai, marking its entry into the $3.2B AI-driven pharma market and expanding beyond radiotherapy toward ML–based drug development.

🔹 Family-led RNA revival—Soufflé Therapeutics, co-founded by Robert Langer and family, launched with a $200M Series A and over $3.5B in total partnerships with AbbVie, Amgen, Bayer, and Novo Nordisk to develop targeted, cell-specific siRNA therapies for metabolic and genetic diseases, aiming for clinical entry in 2026.

🔹 US boosts next-gen immune engineering—ARPA-H awarded over $170M across projects advancing in vivo cell therapies, funding newly launched ImmunoVec ($40.7M), Tessera Therapeutics, Kernal Bio ($48M), and Cytiva to develop nonviral DNA, mRNA, and CRISPR delivery systems that reprogram immune cells directly inside the body for cancer and autoimmune diseases.

🔹 Italy’s Chiesi Group will pay up to $115M for global rights to Arbor Biotechnologies’ gene-editing therapy with potential downstream payments topping $2B, marking a bet on one-time treatments for rare kidney disorders.

🔹 Bristol Myers Squibb will acquire Orbital Therapeutics for $1.5B, expanding into RNA-delivered, in vivo CAR-T therapies led by a preclinical CD19 autoimmune program.

🔹 European healthtech goes global—Lauxera Capital closed its €400M Lauxera Growth II fund to scale European healthtech innovators internationally, already backing Acandis and Antaros Medical, and continuing its hands-on, transatlantic model that helped drive OrganOx’s $1.5B exit to Terumo.

🔹 LongeVC doubles down on longevity biotech—a month after revealing plans to raise $120M for its second fund amid a tight VC market, LongeVC officially launched Fund II, backing translational longevity and deep-tech startups. Its first investment, an €80M Series A in Trogenix, supports genetic therapies for aggressive cancers like glioblastoma, co-led by IQ Capital with participation from Eli Lilly and Cancer Research Horizons.

🔹 Massive boost for UK science hub—Oracle founder Larry Ellison will invest an additional £890M to expand his Oxford research institute into a 2M sq ft campus for 7,000 people, aiming to tackle global challenges like health, food security, and climate change, with projected economic benefits worth billions.

🔹 AI drug discovery firm embraces crypto strategy — Predictive Oncology raised $343.5M through private financings combining cash and Aethir’s ATH tokens to fund a new digital asset treasury and create a “Strategic Compute Reserve,” tying its AI drug discovery platform to decentralized GPU infrastructure.

🔹 Next-gen protein degraders—Leash Biosciences signed a multi-target collaboration withto supply novel chemistries for degrader discovery against hard-to-drug targets. The partnership follows Monte Rosa’s up-to-$5.7B deal with Novartis and builds on its AI/ML discovery engine which uses geometric deep learning to map protein surfaces and design highly selective molecular glue degraders.

⚙️ Other Tech

(Innovations across quantum computing, BCIs, gene editing, and more)

🔹 Circuit-level control of immunity—Nilo Therapeutics launched with $101M to modulate mapped vagal–brain “master regulator” circuits that gate systemic inflammation—aiming for multi-pathway immune reset vs. single-cytokine drugs. Founded by Zuker, Medzhitov, and Liberles, the NY startup is building labs and advancing preclinical programs with backing from The Column Group, DCVC Bio, Lux, the Gates Foundation, and Alexandria.

🔹 Gene therapy pioneer targets the rarest diseases—James Wilson’s GEMMABio launched Rare Therapeutics, a spinout developing gene therapies for ultra-orphan CNS disorders (e.g., GM1 gangliosidosis, Krabbe disease).

🏛️ Bioeconomy & Society

(News on centers, regulatory updates, and broader biotech ecosystem developments)

🔹 Publishers tighten controls on open-data studies—PLOS, Frontiers, and other journals are now automatically rejecting most papers using public health datasets like NHANES unless researchers provide external validation, after thousands of suspect, AI-generated studies flooded submissions; the move aims to curb paper mills but raises concerns about access for legitimate scientists.

🔹 U.S. precision oncology flywheel—DeciBio’s Andrew Aijian highlights how leading U.S. diagnostics firms are linking assays, multiomic databases, pharma partnerships, and algorithm development into a connected “flywheel” model. Companies like Caris, Tempus, Foundation Medicine, Guardant, and Natera are using this approach to improve biomarker discovery and assay utilization, though questions remain around reimbursement, data ownership, and global scalability.

🔹 Owkin and STAT Brand Studio released a Pulse Check report surveying 200 U.S. and European pharma leaders on agentic AI, exploring how self-directed AI systems that can plan and act autonomously are reshaping strategies, budgets, and adoption barriers across drug discovery and clinical research.

🔹 UC sets Nobel world record—University of California researchers won five Nobel Prizes in three days (in medicine, physics, and chemistry) marking the first time four faculty from one institution earned Nobels in a single year and bringing UC’s total to 75.

🔹 In 2025, big pharma’s median upfront payment for Phase I licensing deals hit $350M (over double 2024 levels) while preclinical and Phase II deal activity remained strong and platform partnerships stayed steady, per DealForma data.

AI for Science is a Social Problem

Hugging Face researchers Georgia Channing and Avijit Ghosh argue that the main barriers slowing AI’s impact on scientific discovery are social and institutional rather than compute, data, or model quality. They describe four obstacles:

They call for shared spaces and collaborative infrastructure to bridge divides between machine learning and domain scientists, an effort now taking shape in their new hugging-science community.

The authors describe four obstacles:

Community breakdowns that prevent collaboration

Research incentives that misalign with high-leverage upstream needs

Fragmented and incompatible datasets

Infrastructure access gaps that reinforce existing institutional privilege

A central issue is communication failure between machine learning researchers and scientists. ML developers often focus on predictive performance, while domain scientists seek mechanistic understanding, leading to mismatches in goals and validation criteria. These gaps are worsened by a lack of interdisciplinary educational resources.

There’s also undervaluing of infrastructure and data contributions. While model iterations are often short-lived, well-curated datasets and shared tools can have long-term utility, yet they rarely receive comparable recognition in funding or career advancement.

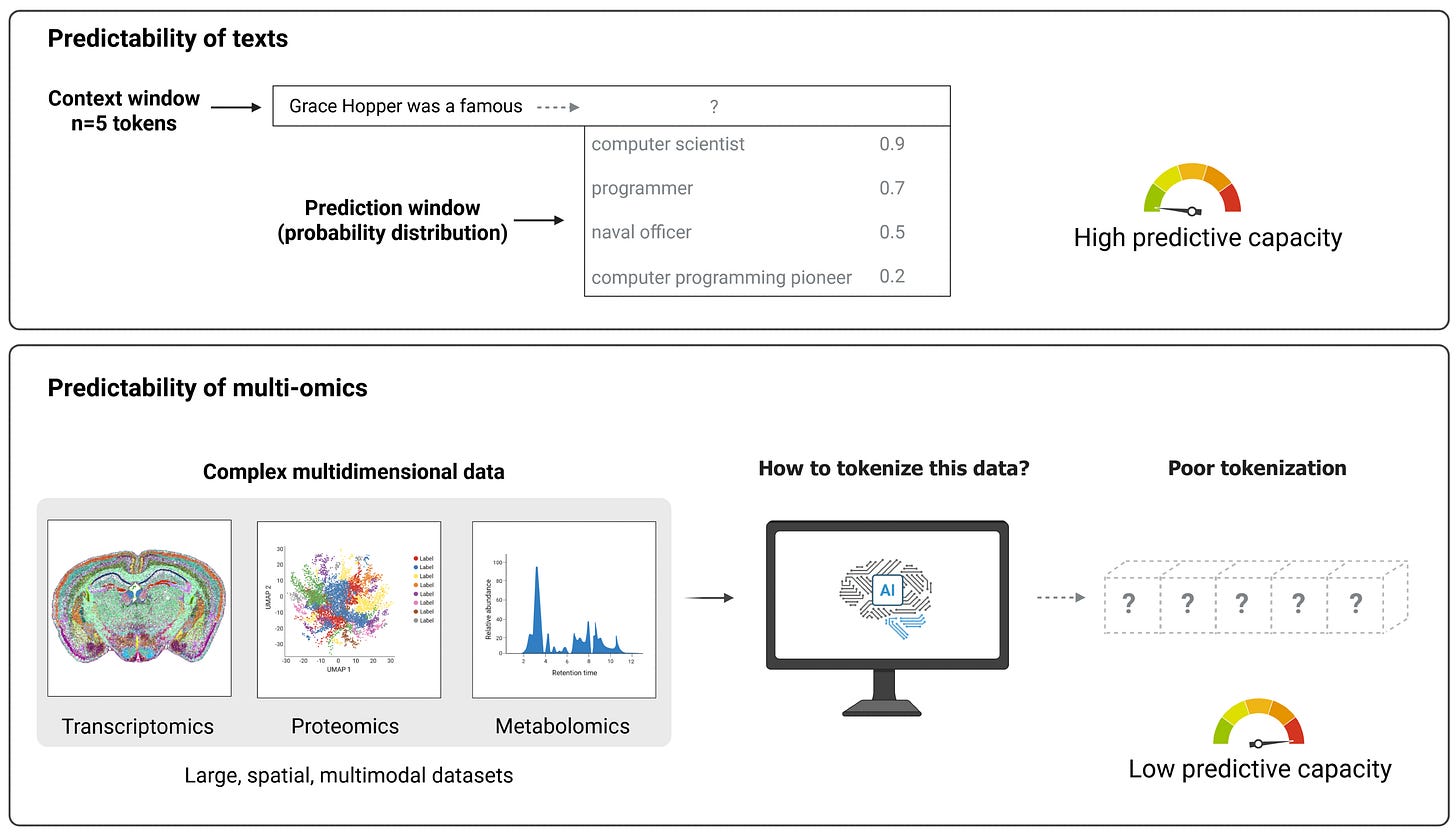

Another key challenge is scientific data tokenization. Unlike text, where tokens are naturally defined and models can exploit local context, scientific datasets (like multi-omics, pathology images, or molecular structures) often lack clear token boundaries and require far larger context windows to capture meaningful relationships.

This results in poor performance from standard transformer architectures, even when data volume is high. The authors emphasize that biological systems in particular often involve long-range spatial or temporal dependencies that current models fail to represent effectively.

Some of the proposed solutions: building standardized interfaces for scientific ML workflows, establishing community benchmarks for upstream computational bottlenecks, prioritizing open data formats, and investing in sustainable, community-owned infrastructure.

The authors argue that unless these social foundations are addressed, technical advances alone will not democratize or accelerate scientific discovery.

Independently Benchmarking Healthcare AI

Quick note on ARiSE: a Stanford- and Harvard-backed lab launched in 2024 to independently evaluate healthcare AI, with a stated focus on clinical reasoning, safety, and explainability rather than raw model scores. The group says it intends to stay non-commercial.

This year, ARiSE reports three main results:

A Nature Medicine paper found large language models could assist physician reasoning in complex vignettes.

An August NEJM AI study introduced MedAgentBench (appeared in preprints earlier this year)—300 physician-written patient tasks run in an agentic setup; where most models did better on query-based than action-based tasks; Claude 3.5 Sonnet led with a 69.67% overall success rate.

A third study comparing LLMs with board-certified physicians across emergency triage, initial evaluation, and admission scenarios reported LLMs outperforming physicians in all three.

Alongside ARiSE’s independent work, OpenAI has built HealthBench with 5,000 physician-graded health conversations contributed by 262 clinicians across 60 countries. Google’s benchmark spans over 11,000 personas covering diverse diseases, regions, languages, and clinical contexts.

As benchmarks take shape, diagnostics is one area where these models are already being used: our a recent deep dive profiles 22 companies and Microsoft’s MAI-DxO, reportedly at 85.5% on 304 NEJM cases using five LLM agents.

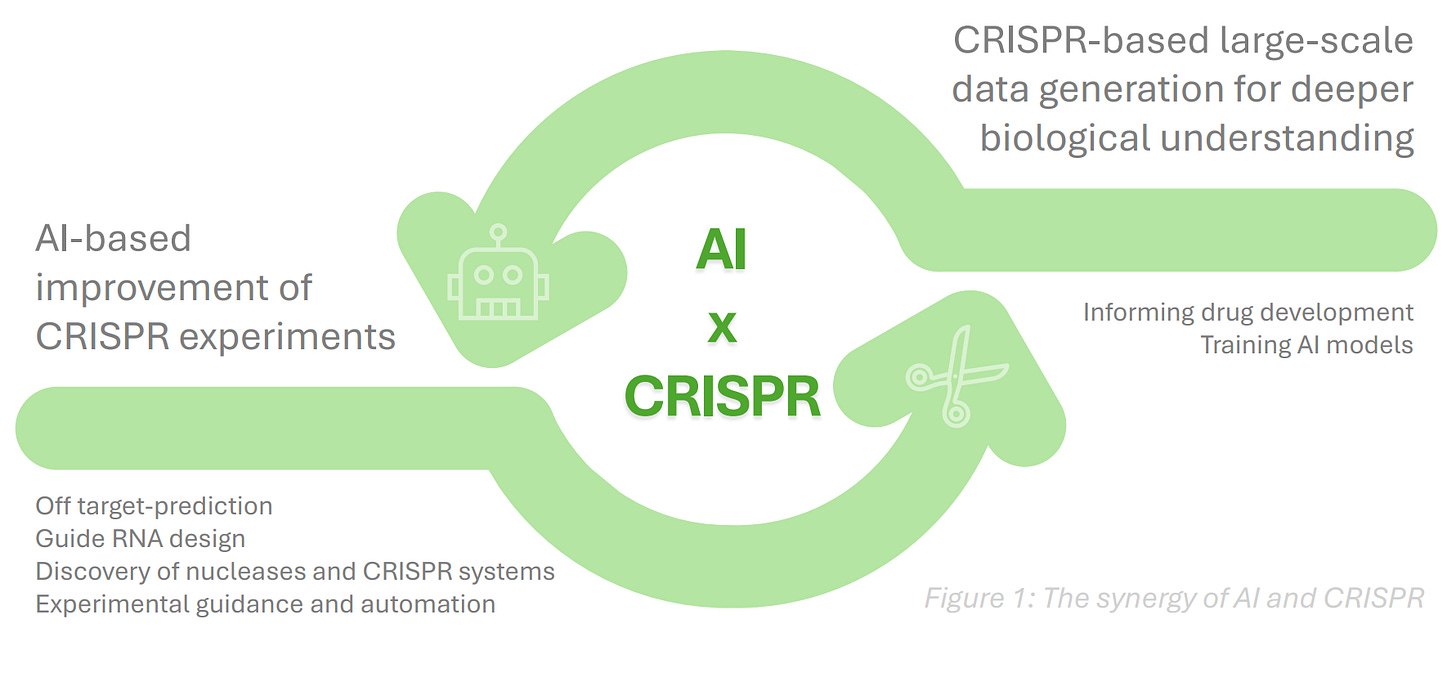

Convergence of AI and CRISPR

In her latest Tech for the Rare column at BiopharmaTrend, Louise von Stechow examines how AI is beginning to intersect with CRISPR gene editing—an emerging convergence with major implications for rare disease therapy. She traces the arc from Casgevy, Vertex’s 2023-approved therapy for sickle cell disease and β-thalassemia, to CRISPR-GPT, a Stanford-, Princeton-, and DeepMind-led AI agent that helped novice researchers reach up to 80% editing efficiency in cell experiments.

Louise also notes how AstraZeneca’s $555 million deal with Algen Biotechnologies reflects growing interest in AI-driven CRISPR platforms for gene–disease mapping, and how Profluent’s OpenCRISPR-1, an AI-designed nuclease differing by 403 mutations from SpCas9, reportedly cut off-target edits by 95%. Meanwhile, the aforementioned Arbor Biotechnologies’ $115 million upfront partnership with Chiesi focuses on CRISPR editing for rare diseases, bringing the field’s industrial potential into sharper view.

The author frames the field as promising but early: CRISPR and AI are starting to reinforce each other, but their convergence is still experimental—raising as many technical and ethical questions as it does possibilities for rare disease research.