Weekly Tech+Bio Highlights #53: Eli Lilly Opens Access to AI Models Trained on $1 Billion Worth of R&D Data

Is the first anti-aging drug class on the horizon? Also: David Baker’s new venture; grounding AI in chemistry & current state of medchem platforms

Hi! This is BiopharmaTrend’s weekly newsletter, Where Tech Meets Bio, where we explore technologies, breakthroughs, and cutting-edge companies.

If this newsletter is in your inbox, it’s because you subscribed, or someone thought you might enjoy it. In either case, you can subscribe directly by clicking this button:

In our recent case study, we look at how Toronto-based Google-backed BenchSci approaches the problem with neurosymbolic AI, a platform linking LLM’s to a structured knowledge graph of over 400 million entities and 1 billion relationships.

🤖 AI x Bio

(AI applications in drug discovery, biotech, and healthcare)

🔹 AI for all in drug discovery — Eli Lilly launches TuneLab, giving biotech partners access to AI models trained on $1B+ worth of proprietary R&D data, aiming to accelerate early-stage drug development through its Catalyze360 initiative.

🔹 Flagship Pioneering partners with IQVIA to boost drug development across its 30+ biotech portfolio, tapping AI and trial technologies to speed clinical progress and strengthen asset strategy.

🔹 AI and chemical intuition — MIT researchers unveil FlowER, a generative model that predicts chemical reactions by simulating electron redistribution, offering physically realistic, explainable pathways for reaction discovery and mechanism prediction.

🔹 Proscia launches a pathology-based AI platform to identify trial-eligible patients at diagnosis, aiming to boost clinical trial enrollment and accelerate biomarker-driven drug development across its 8M-case diagnostic network.

🔹 AI learns the Game of Life — MIT’s Markus J. Buehler and grad student Jaime Berkovich publish LifeGPT, a topology-agnostic transformer that learns cellular automata dynamics without prior knowledge of grids or boundaries, achieving near-perfect accuracy in modeling Conway’s Game of Life.

🔹 AI-first biotech snapshot — Luka Jelcic and Eliza French at DeciBio update the TechBio R&D landscape, now tracking 523 AI-led drug programs; autoimmune saw the biggest growth, while oncology posted a net decline, and six companies pulled pipeline visibility.

🔹 LatchBio releases a 25-million-cell open-source spatial transcriptomics atlas across 45 tissues and 63 diseases, integrating data from 11 platforms and launching new tools for analysis, annotation, and visualization.

🔹 AI-guided GBM trial cleared — Lantern Pharma’s Starlight Therapeutics receives FDA IND clearance for a Phase 1b/2a trial in recurrent glioblastoma, combining a brain-penetrant DNA-damaging agent with spironolactone to exploit synthetic lethality.

🚜 Market Movers

(News from established pharma and tech giants)

🔹 Novartis partners with BioArctic in a $30M upfront deal (with up to $772M in milestones) to develop a neurodegeneration therapy using BioArctic’s BrainTransporter platform for enhanced brain uptake.

🔹 RNAi targets Parkinson’s — Novartis also inks $2.2B deal with Arrowhead to license a preclinical RNA therapy targeting alpha-synuclein, aiming to revive efforts in Parkinson’s and expand CNS delivery using Arrowhead’s RNAi platform.

🔹 Vertex partners with Enlaza in a $2B+ deal to develop covalent T-cell engagers and drug conjugates for autoimmune diseases and improved gene therapy conditioning, leveraging Enlaza’s synthetic biology platform.

💰 Money Flows

(Funding rounds, IPOs, and M&A for startups and smaller companies)

🔹 AI meets nature for drug discovery — Enveda raises $150M in Series D to advance AI-driven small molecule therapies for inflammatory and metabolic diseases, begins Phase 1b trial in atopic dermatitis, and adds ex-Pfizer R&D chief to its board.

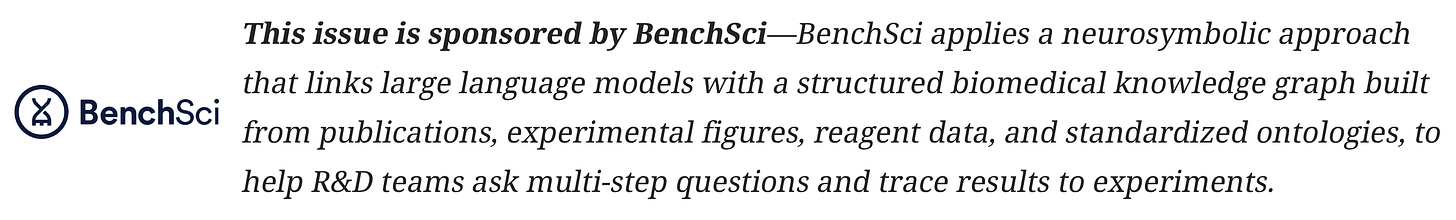

🔹 Tackling drug resistance in leukemia — David Baker’s CHARM Therapeutics raises $80M Series B to advance an AI-designed menin inhibitor for treatment-resistant acute myeloid leukemia, aiming to begin clinical trials in early 2026.

🔹 Backing biotech through growth — Atlas Venture closes $400M Opportunity Fund III to support later-stage rounds for its biotech portfolio, following its $450M early-stage fund raised in late 2024.

🔹 Cancer biotech hits $1.1B — Josh Bilenker’s Treeline Biosciences raises $200M, bringing total funding to $1.1B as it advances three cancer drugs in Phase 1 and expands into neurology and autoimmune, while trimming select early-stage projects.

🔹 CRISPR and epigenetics — China-based Epigenic Therapeutics raises $60M to advance epigenome-editing therapies into a Phase 1/2 trial for hepatitis B, entering a competitive field alongside U.S. rivals like nChroma and Tune.

🔹 Restoring hearing with cell therapy — Lineage Cell Therapeutics secures up to $12M from William Demant Invest to advance ReSonance, a transplant of off-the-shelf auditory neurons for treating auditory neuropathy, in partnership with Oticon’s Eriksholm Research Centre.

🔹 Takeda-backed Integra Therapeutics raises €10.7M pre-Series A to advance its FiCAT gene writing platform and preclinical CAR-T therapies, with support from the EIC Fund, CDTI Innvierte, and existing biotech investors.

⚙️ Other Tech

(Innovations across quantum computing, BCIs, gene editing, and more)

🔹 Proteomics at scale — Illumina begins broad rollout of its Protein Prep platform, enabling analysis of up to 9,500 proteins per sample ahead of its $425M SomaLogic acquisition.

🔹 Hernia trial success — Medtronic’s Hugo robot met safety and efficacy goals with zero conversions in U.S. hernia repair trial, supporting its FDA review.

🏛️ Bioeconomy & Society

(News on centers, regulatory updates, and broader biotech ecosystem developments)

🔹 FDA proposes flexible path for ultrarare diseases — a new framework would allow single-arm trials plus supportive data for drugs targeting genetic causes of ultrarare conditions, though analysts question its real-world impact and narrow eligibility.

🚀 A New Kid on the Block

(Emerging startups with a focus on technology)

🔹 Industry veterans Meanwell and Maraganore launch Corsera Health with $50M to develop a once-yearly RNAi therapy targeting cholesterol and blood pressure, alongside an AI tool for lifetime heart risk prediction, aiming to transform cardiovascular prevention.

🔹 New spin-out targets cancer driver — A2A Pharmaceuticals launches Coiled Therapeutics (per A2A’s Edward Painter), to advance a first-in-class TACC3 inhibitor for solid tumors, with plans for a London listing and £6M in committed funding.

This newsletter reaches over 9.5K industry professionals from leading organizations across the globe. Reserve your sponsor slot in one of the upcoming issues.

Contact us at info@biopharmatrend.com

Federated Learning Meets Decades of R&D Data

Eli Lilly has launched TuneLab, a platform giving external biotech companies access to its proprietary AI models for drug discovery. The models draw on decades of preclinical, molecular, and safety data, which Lilly estimates cost more than $1 billion to generate.

The setup uses federated learning, so raw data never leaves either Lilly or its partners. Instead, encrypted model gradients are exchanged. Hosting is handled by a third party to strengthen privacy. Partners can also contribute their own experimental data, feeding back into the system while protecting IP. According to Lilly, this creates a bi-directional learning loop that improves the shared models over time.

The current set of models spans ADME profiling, toxicology and safety pharmacology, PK/PD data, molecular property predictions, and results from preclinical screening across hundreds of thousands of compounds. These models are intended to support early workflows like compound triage, risk assessment, and lead optimization. Future versions, Lilly says, will include in vivo small molecule predictive models, exclusive to TuneLab.

Chief Scientific Officer Daniel Skovronsky commented that “Lilly has spent decades building comprehensive datasets for drug discovery. We're now making the intelligence trained on that data accessible to others in the ecosystem.”

TuneLab is the latest addition to Catalyze360, Lilly’s broader initiative that already includes venture funding via Lilly Ventures, shared lab facilities through Gateway Labs, and R&D collaborations under ExploR&D. With TuneLab, Lilly adds an AI infrastructure component to this stack, aimed at startups that typically lack large-scale proprietary data and models.

ARDD 2025: GLP-1s Pitched as a Longevity Platform

BiopharmaTrend co-founder Andrii Buvailo attended ARDD 2025 in Copenhagen this August and flagged one talk in particular from Andrew Adams, Group VP of Molecule Discovery and Director of Genetic Medicines at Eli Lilly. Adams described an interesting case for GLP-1 receptor agonists as more than metabolic treatments, instead, positioning them as a potential cornerstone in the future of preventative, longevity-focused medicine.

What Adams highlighted: data showing GLP-1s (originally developed for type 2 diabetes) can reduce progression from pre-diabetes to diabetes by up to 94%, alongside reported reductions in major adverse cardiovascular events and mortality.

Signals beyond glucose: the presentation touched on signals across other age-associated conditions, including vascular function and vascular dementia, cognitive decline, certain mental health conditions, and addiction and substance-use disorders.

From sick care to proactive care: the vision shifts from reactive “sick care” to more proactive health management, with GLP-1s proposed as tools in long-term risk reduction. Adams also pointed to dosing innovations that could support adherence in older populations, such as infrequent dosing schedules on the order of monthly or yearly via approaches like PCSK9 editing or SIRNA-based platforms.

There’s also a nod to Alzheimer’s work from Eli Lilly’s Trailblazer-2 study, where donanemab slowed cognitive decline by about 35% versus placebo, with the effect most evident in earlier disease stages.

If ongoing trials bear out and clinical practice follows, GLP-1s and adjacent molecules could potentially emerge as the first anti-aging drug class, with implications for compressing morbidity, lowering system costs, and extending healthspan.

David Baker’s AI-Designed Leukemia Drugs

David Baker’s new venture, CHARM Therapeutics, just raised an $80M Series B, bringing total funding past $150M with NVIDIA, Khosla Ventures, NEA, SR One, OrbiMed, and F-Prime among its backers.

The company is using its DragonFold platform—an AI system for protein–ligand co-folding—to develop next-gen menin inhibitors for AML (acute myeloid leukemia). First-wave inhibitors are already running into resistance mutations, and CHARM’s pitch is a molecule that stays potent across all known mutations.

Their lead candidate is said to drive tumor regression in preclinical models, work at low doses, and avoid drug–drug interactions. CHARM’s figure above illustrates how the AI-designed molecule inhibits the binding of KMT2A (enzyme involved in the onset of leukemia) with menin, which leads to differentiation and apoptosis of leukemic cells

Trials are arranged for early 2026. If it pans out, this could make menin inhibition more durable for AML and underscores how AI-native drug design is moving into the clinic — though major funding still seems clustered among a few players.

Grounding AI in Chemistry

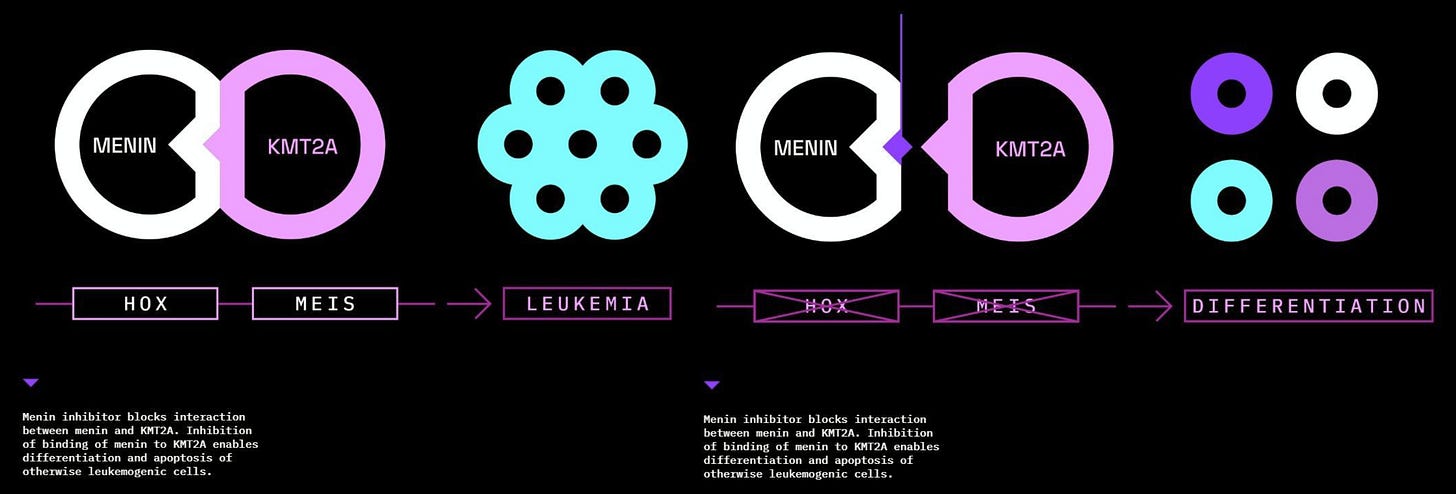

AI models have long been used to predict chemical reactions, but they often underperform due to the ignorance of basic physics, such as the law of mass conservation. A team at MIT approached the issue by building these constraints directly into their system. The results were recently published in Nature (February pre-print).

Their model, FlowER (Flow matching for Electron Redistribution), is based on bond-electron (BE) matrices to track bonds and lone pairs through each elementary step. Instead of only guessing end products, it tracks the electron movement, so atoms/electrons are conserved by construction. The example of a BE matrix in action is highlighted in the scheme below. The main goal of FlowER is to predict the changes in the BE matrix, which represent the electron redistribution from reactants to products.

The current release is a proof-of-concept trained largely on the USPTO-Full dataset, coverage of metals and catalytic cycles is still limited. Even so, it matches or beats common baselines on valid mechanistic pathways and can generalize to new reaction types.

Model and datasets are open source on GitHub. The group sees this as a starting point: next steps include expanding to catalytic cycles and exploring how the method can help design new reactions.

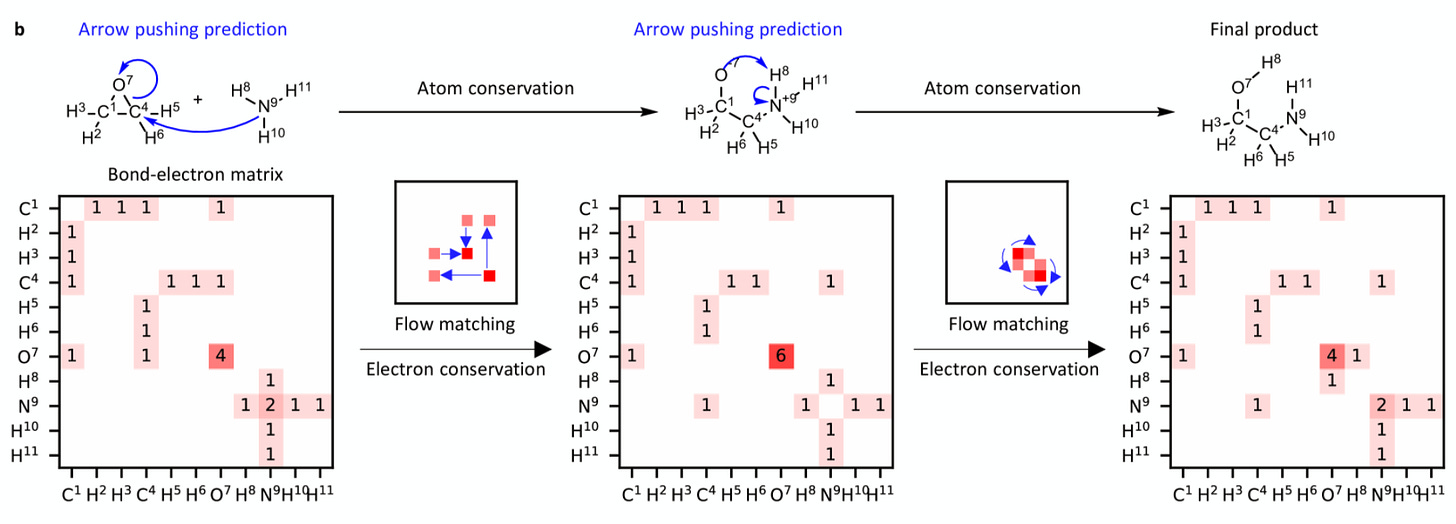

Current State of MedChem AI

Andrii Buvailo recently took note of where AI is actually helping medicinal chemistry—synthetic planning and scale‑up, the “boring part” where promising ideas can hit costly bottlenecks or fail to translate into manufacturable candidates, even with a strong biological hypothesis.

Retrosynthesis feels grown‑up: Platforms like ChemAIRS (Chemical.AI), ASKCOS, Spaya (iktos), molecule.one, and SYNTHIA (Merck) generate viable, literature‑backed, increasingly scalable routes in minutes. ChemAIRS layers in supply‑chain awareness and cost‑efficiency. One example: a ChemAIRS‑proposed 25‑step synthesis of elironrasib (a KRAS‑G12C(ON) inhibitor) mirrored the patented route, introduced modular efficiencies, and flagged risks.

Beyond retrosynthesis: AI is being used for route scouting, forward reaction prediction, and synthetic feasibility filtering—so virtual libraries can be screened for makeability, not just novelty.

There are gaps: Process development and scale‑up still bite. Reaction viability at the gram scale doesn’t always translate at the kilo scale. More capable models are needed for impurity formation, crystallization, thermal behavior, PMI, and related constraints.

Direction of travel is toward AI‑native process development: digital twins that integrate machine learning with plant data, real‑time impurity modeling, and predictive crystallization simulations.

All in all, AI is moving from “Can we make this?” to “Which route is best to make now and at scale?”